Whitepaper: The Audit World's Biggest Myths

Download NowWe can help you with everything from evaluating your Incurred Cost Submission compliance status to settling audit issues.

Does your organization have contracts containing FAR clause 52.216-7 Allowable Cost and Payment? If so, an annual Final Indirect Cost Rate Proposal, more commonly referred to as the Incurred Cost Proposal or Incurred Cost Submission (collectively ICP / ICS) is required.

Flexibly-priced contracts, such as Cost-Reimbursement and Time-and-Materials, provide for reimbursement of indirect costs based on estimated indirect expense billing rates. These estimated rates require adjustment on an annual basis to determine final indirect cost rates based on actual incurred costs for the contractor’s fiscal year. These final rates determine whether the contractor owes the Government for overbillings or the Government owes the contractor for underbillings.

The requirement to submit a FAR-based Incurred Cost Submission is contained in FAR clause 52.216-7(d)(2)(i) – Allowable Cost and Payment, which states, “The contractor shall submit an adequate final indirect cost rate proposal to the contracting officer (or cognizant federal agency official) and auditor within the 6-month period following the expiration of each of its fiscal years.” This means the date is June 30th for contractors with a calendar fiscal year end of December 31.

As the primary purpose of the ICP / ICS is the finalization of indirect expense rates and, secondarily, justification of claimed direct contract costs, including subcontractor billings, compiling the information necessary to prepare the schedules required for an “adequate” – meaning the proposal is adequate as deemed by the Defense Contract Audit Agency (DCAA) in accordance with their ‘Checklist for Determining Adequacy of Contractor Incurred Cost Proposal’ - submission can be a challenge for any contractor.

The information included in the schedules demonstrate a contractor’s compliance with Accounting System requirements for appropriate identification of direct vs. indirect costs, accumulation and allocation of indirect costs to indirect cost pools, exclusion of unallowable costs and understanding of FAR 31.205 cost principles, and compliance with cost reimbursement contract requirements.

With consequences that can escalate to penalties for claiming expressly unallowable costs and even violations of the False Claims Act, the ICP / ICS is a significant aspect of compliance in contracting with the Federal Government on flexibly-priced contracts. More than just an accounting and finance effort, it requires input from a variety of functional areas within an organization, such as contracts, purchasing, program management, and human resources.

Audits of ICP / ICS present their own challenges to the contractor as these audits have historically represented the largest amount of dollars examined by the Defense Contract Audit Agency (DCAA) relative to all other types of audits. Whether it’s preparation of the submission schedules, guidance on cost allowability, audit support, or navigating requirements after receiving final rate determinations, Capital Edge’s team of experts have the expertise and experience to support your organization.

At Capital Edge, our experts have extensive experience supporting contractors ranging from small businesses to Fortune 500 companies across a variety of industries in addressing this complex contract requirement.

All of our clients’ needs are different. We tailor our approach to meet the needs and business objectives of each-and-every client. Our experts have extensive experience supporting Federal contractors with their ICP / ICS needs, including incurred cost audit support.

The requirement to submit a FAR Incurred Cost Submission is contained in FAR clause 52.216-7(d)(2)(i) – Allowable Cost and Payment, which states, “The contractor shall submit an adequate final indirect cost rate proposal to the contracting officer (or cognizant federal agency official) and auditor within the 6-month period following the expiration of each of its fiscal years.” This means the date is June 30th for contractors with a calendar fiscal year end of December 31.

Here are the latest questions being asked about ICS

The Office of Federal Procurement Policy (OFPP) has not published the 2020 compensation cap amounts. However, the OFPP did post the formula to be used to calculate the cap. The cap has also been released by DCAA in MRD 20-PSP-004(R) dated August 20, 2020.

Cap is for contracts awarded after June 24, 2014.

No, the DCAA ICE Model is not required, however the required information that it contains is. Contractors have the ability to submit using their own format or template with the same required information.

The DCAA Incurred Cost Submission Adequacy Checklist is can be found here on the DCAA website.

An incurred cost proposal or incurred cost submission is required for Federal contractors who have flexibly priced contracts or subcontracts containing FAR 52.216-7 – Allowable Cost and Payment clause. It is due within 6 months following the end of the contractor’s fiscal year. For most contractors with a December 31 fiscal year end, the submission is due the following June 30th.

The incurred cost audit can occur anytime after the ICS is submitted. Typically, the audit happens months to years after submission.

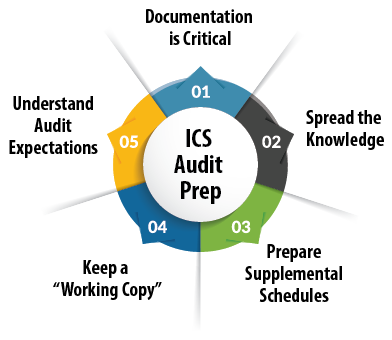

Given this delay related to incurred cost audits, it is important to ensure that the data supporting the ICS is organized and available when the audit starts. Check out this video to learn best practices for preparing for the incurred cost audit while preparing the ICS.